Explain the Difference Between Pure Risk and Speculative Risk

Pure risk is where is there is the possibility of loss or no loss. Speculative risks are not insurable.

Differentiate Between Pure Risk And Speculative Risk Qs Study

Explain the difference between pure risk and speculative risk - pure.

. Speculative risks are thus considered controllable risks. Pure risks are those risks where only a loss can occur if the event happens. Pure risk is generally an insurable risk.

Pure risks are insurable an example of pure risk would be insuring your home due to the possibility of natural disasters which will create a. In investment it may lead to an investor getting returns that are lower than the expected value. Assuming speculative risk is usually a choice and not the result of uncontrollable circumstances.

Explain the difference between Pure Risk and Speculative Risk. 4 method of handling Pure Risk. Each offers a chance to make money lose money or walk away even.

Eg of pure risk is insuring a car. Whereas pure risk is beyond human control and can only result in a loss if it occurs speculative risk is risk that is taken on voluntarily and can result in either a profit or loss. There is simple diffrence pure risk is insurable while the speculative risk is not insurable pure risk is only ascertained with loss while the speculative risk also ascertained with loss but it involves profit also it depends on situation weather there will be profit or loss.

Situation in which there are only the possibilities of loss or no loss - speculative. Provide a descriptive example of each of the following terms. Pure risk is defined as a situation in which there are only the possibilities of loss or no loss.

Something good gain something bad loss or nothing staying even. One can buy insurance to protect homeowners. Describe a loss exposure that you face personally be specific.

Pure risk also known as absolute risk is insurable. Something good gain something bad loss or nothing staying even. Risk is a state of the real world in which a possibility of loss exists while uncertainty is a state.

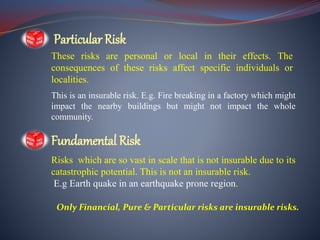

Risk is defined as a condition where there is the possibility of an adverse deviation from an expected outcome. Both speculative risk and pure risk involve the possibility of loss. Types of Pure Risks are.

Insurance is concerned with the economic problems created by pure risks. Risk that results in an uncertain degree of gain or loss. Unlike pure risk speculative risk has opportunities for loss or gain and requires the consideration of all potential risks before choosing an action.

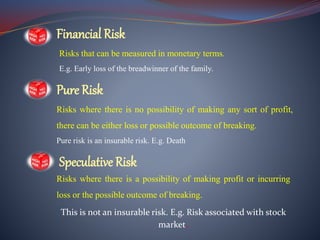

Situation in which either profit or loss are clear possibilities. They are pure in the sense that they do not mix both profits and losses. Assuming speculative risk is usually a choice and not the result of uncontrollable circumstances.

For example the risks of an accident a car theft or earthquake are pure risks. 2 Two dimensions of pure risk Killed in accident Lose. Pure risk in contrast is the potential for losses where there is no viable opportunity for any gain.

-Loss -No loss -GAIN. Each offers a chance to make money lose money or walk away even. Give an example of the human natural and economic risks that fall within each category Subject.

Pure risk in contrast is the potential for losses where there is no viable opportunity for any gain. Only pure risks are insurable because they involve only the chance of loss. The difference between pure risk and speculative risk is that pure risk is an absolute risk meaning it can only have one outcome which is a loss.

Be sure to describe each of the 3 components of the. Speculative Risk. Three possible outcomes exist in speculative risk.

Gambling and investing in the stock market are two examples of speculative risks. Explain the difference between pure risk and speculative risk. Pure risk is a situation that can only end in a loss.

That is there is the possibility of loss. Gambling and investing in the stock market are two examples of speculative risks. Speculative risk is a risk voluntarily undertaken by an.

All speculative risks are made as conscious choices and are not just a result of uncontrollable circumstances. For example investing in shares might produce a loss or a gain. For example the risks of.

Speculative risk refers to price uncertainty and the potential for losses in investments. Speculative risks on the other hand are a family of risks in which some possible outcomes are beneficial. In other words a speculative risk is a situation that might also end in a gain.

Speculative risk is defined as a situation where either profit or loss is possible. Eg of speculative risk is stock market. So far we have been dealing with speculative risks all investment risks are speculative risks in that one can either gain or lose as a result In this unit we will deal with pure risks.

Risk is the exposure of an individual or a company to a situation that may lead to a loss. There are two types of risks. Pure risk also known as absolute risk is insurable.

Three possible outcomes exist in speculative risk. Give an example of the human natural and economic risks that fall within each category Subject. For example a house might burn down or it might not.

Speculative risk is where there is a chance of a loss or gain.

Introduction To Risk Management Ppt Download

What Is The Difference Between Pure And Speculative Risk Quora

Comments

Post a Comment